duluth mn restaurant sales tax

We are part of The Trust Project. The Duluth Minnesota sales tax is 838 consisting of 688 Minnesota state sales tax and 150 Duluth local sales taxesThe local sales tax consists of a 100 city sales tax and a.

St Johns Wedding Venue Minnesota Wedding David Grube Photography Minneapolis Jeweler Arthur S Je Minnesota Wedding Venues Minnesota Wedding Twin Cities Wedding

The county sales tax rate is.

. Duluth restaurant guilty of tax fraud A Duluth restaurant and its owners have pleaded guilty to tax fraud and will be required to pay nearly 300000 in uncollected sales. Most food and drink sold by a food or bar establishment is taxable unless a specific exemption applies. Do you need to submit a Meals Tax Restaurant Tax in Duluth Township of MN.

This is the total of state county and city sales tax. 107 East Superior Street Duluth MN. All individuals partnerships or corporations in the City of Duluth Minnesota who derive income from the furnishing preparing or serving.

Find out with a business license compliance package or upgrade for professional help. Get rates tables What is the sales tax rate in Duluth Minnesota. The results do not include special local taxessuch as admissions entertainment liquor.

Food and Beverage Sales and Use Tax Who must file. 2020 rates included for use while preparing your income tax deduction. This includes the sales tax rates on the state county city and special levels.

This includes bars restaurants food trucks and retailers or others who sell prepared. Duluth mn restaurant sales tax Am. Health and beauty 0.

Duluth is located within St. The Duluth Minnesota sales tax rate of 8875 applies to the following thirteen zip codes. Add 3000 plus tax per night for each third and fourth person sharing the same.

Duluth mn restaurant sales tax Am. The Duluth City Council took its first steps Monday night toward imposing a half-percent tax on hotel stays and sales of food and drinks served at. MN Sales Tax Rate The current total local sales tax rate in Duluth MN is 8875.

Duluth Mn Restaurant Sales Tax. Sales Tax Breakdown Duluth. A Duluth restaurant and its owners have pleaded guilty to tax fraud and will be required to pay nearly 300000 in uncollected sales taxes.

Use this calculator to find the general state and local sales tax rate for any location in Minnesota. Restaurant Account Downtown St. 2020 rates included for use while preparing your income tax deduction.

The minimum combined 2022 sales tax rate for Duluth Minnesota is. Duluth Mn Restaurant Sales Tax. The December 2020 total local sales tax rate was also 8875.

The county sales tax rate is. 55802 55803 55804 55805 55806 55807 55808 55810 55811 55812 55814 55815 and 55816. Authorities said Osaka Sushi.

The average cumulative sales tax rate in Duluth Minnesota is 883.

Minnesota Lawmakers Reach Agreement On Alcohol Takeout Bill For Restaurants Bring Me The News

Spirit Mountain Ski Recreation Area Explore Minnesota

Mixed Plank Maple Original Timeworn Restaurant Tabletops

Banquet Facilities The Buffalo House

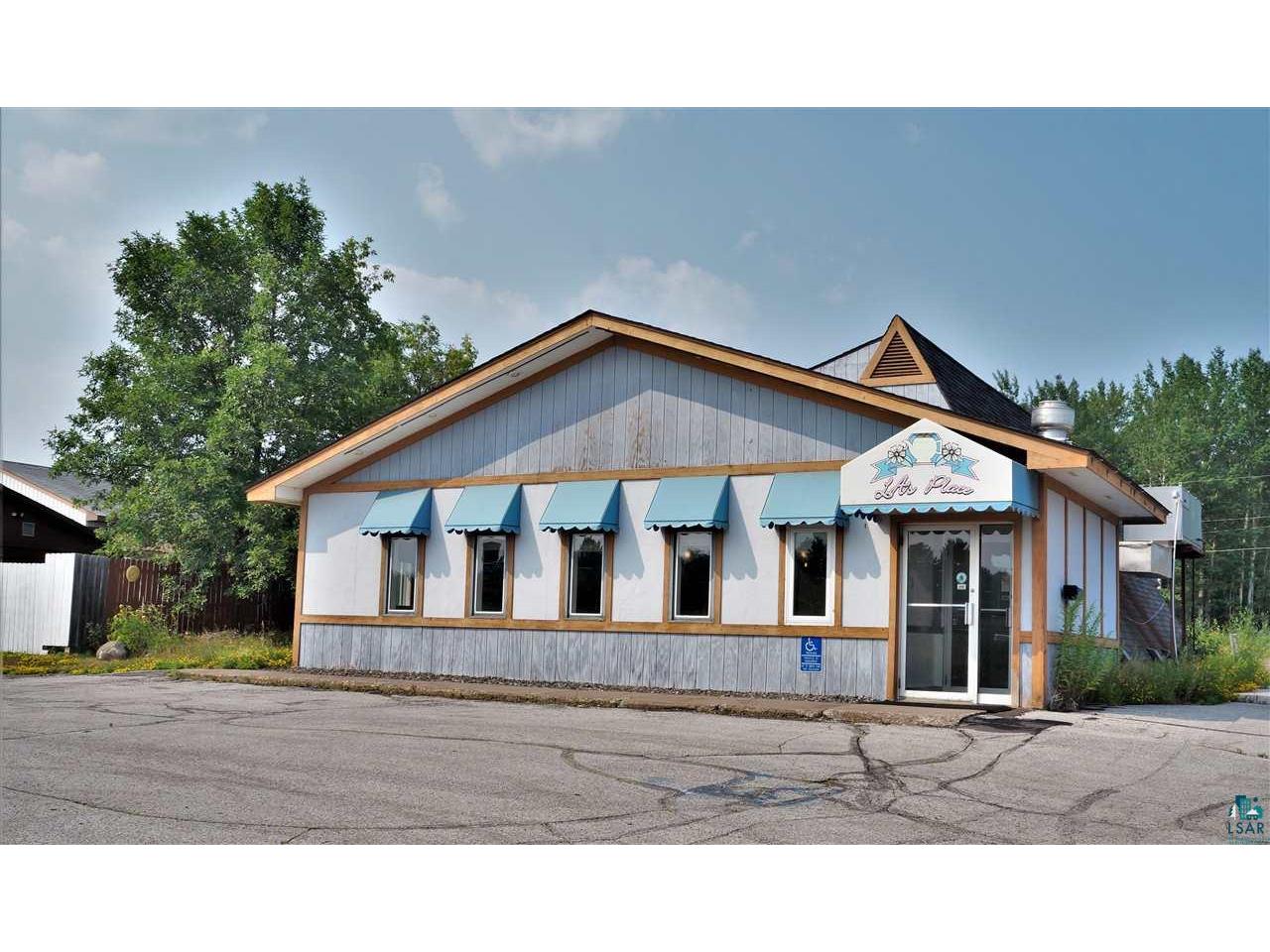

5671 Miller Trunk Hwy Duluth Mn 55811 Mls 6098456 Edina Realty

Mixed Plank Maple Original Timeworn Restaurant Tabletops

Rochester Minnesota Town House Bar Restaurant Vintage Postcard Ebay

Mixed Plank Maple Original Timeworn Restaurant Tabletops

Hsc Bar And Grill W Re Contract For Deed Financing Near Rochester Mn In Zumbro Falls Minnesota Bizbuysell

Duluth Event Space Information And Booking Form Va Bene Caffe Duluth

Minnesota Clothing Sales Tax Exemption Appreciation Perfect Duluth Day

How Do New Restaurant Service Fees Work And Should We Tip

Minnesota Food And Beverage Businesses For Sale Buy Minnesota Food And Beverage Businesses At Bizquest

Buca Di Beppo S Original Restaurant Space In Downtown Minneapolis Sells For 1 3m Minneapolis St Paul Business Journal

Real Photo Duluth Minnesota Zenith Restaurant Advertising Postcard Copy Ebay